XRP Price Prediction: Analyzing the Path to $4.39 Amid Market Volatility

#XRP

- Technical indicators show XRP trading above key support with potential resistance at $3.1487

- Mixed news sentiment with positive institutional demand offset by emerging competition

- Analyst consensus points toward a realistic $4.39 price target amid current market conditions

XRP Price Prediction

Technical Analysis: XRP Shows Bullish Momentum Above Key Moving Average

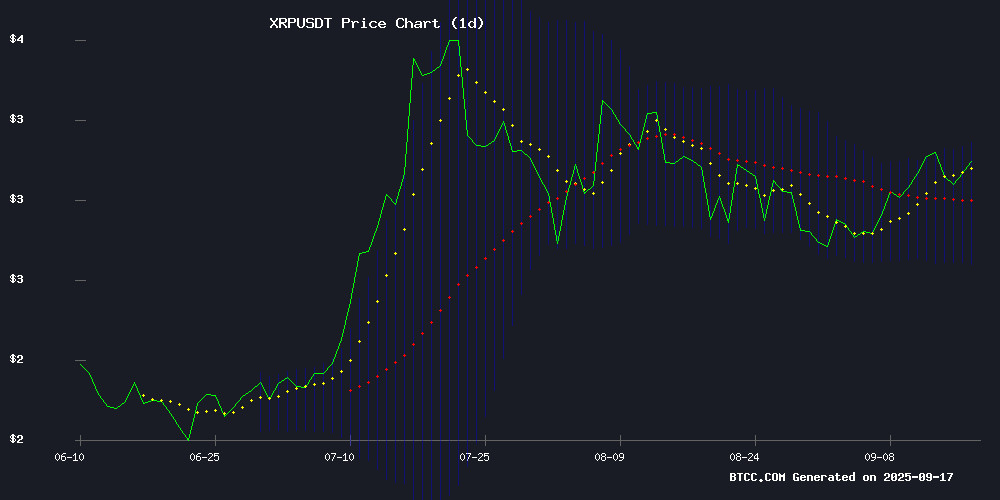

XRP is currently trading at $3.0348, positioned above its 20-day moving average of $2.9218, indicating underlying strength. The MACD reading of -0.0930 suggests some near-term bearish momentum, though the histogram shows improving conditions. The price sits comfortably within the Bollinger Bands range of $2.6950 to $3.1487, with the middle band providing solid support. According to BTCC financial analyst James, 'The technical setup suggests consolidation with upward bias, with a break above $3.15 potentially triggering further gains toward resistance levels.'

Market Sentiment: Mixed Signals Amid Competition and Institutional Interest

Current news FLOW presents a complex picture for XRP. Positive developments include analyst predictions targeting $4.39 and highlighting hidden supply constraints amid rising institutional demand. However, competition from new payment tokens like Remittix and the dismissal of unrealistic $10,000 price targets create headwinds. BTCC financial analyst James notes, 'While institutional interest provides fundamental support, increased competition in the payment token space requires careful monitoring of XRP's competitive positioning in the evolving digital asset landscape.'

Factors Influencing XRP's Price

XRP Price Prediction Adjustments Amid Rising Competition from New Payment Token

Analysts are revising xrp price predictions downward as a new pre-launch payment token, dubbed 'XRP 2.0,' gains traction in the crypto market. The token's emergence has introduced fresh competition in the remittance sector, where Ripple's XRP has long been a dominant player.

Technical analysis reveals XRP struggling to break the $3.08 resistance level since mid-August, further dampening bullish sentiment. While Ripple continues to forge cross-border partnerships, price action remains sluggish, prompting some analysts to question its near-term upside potential.

The market appears to be shifting focus toward newer alternatives, with the unnamed pre-launch token drawing comparisons to XRP's early days. This development underscores the crypto sector's relentless pace of innovation, where today's leaders face constant pressure from tomorrow's disruptors.

Analyst Reveals XRP's Hidden Supply Constraint Amid Rising Institutional Demand

Versan Aljarrah, founder of Black Swan Capitalist, has ignited debate with his claim that XRP's effective circulating supply is drastically lower than market estimates. The financial strategist asserts that escrowed holdings and institutional reserves have artificially inflated perceived liquidity—a misconception that could trigger violent price movements as tokenization demand accelerates.

Tokenized assets spanning gold, debt instruments, and stablecoins may soon collide with this unrecognized scarcity. Aljarrah warns of an overnight supply crunch should institutional capital enter the XRP ecosystem en masse. His YouTube analysis frames the supply mechanics as a critical design feature rather than a technical footnote—one that could redefine XRP's valuation framework in global finance.

Ripple’s Phoenix Breakout: Analysts Predict $4.39 XRP Price Target

Ripple (XRP) is consolidating its position as a dominant force in cross-border payments, with recent technical patterns suggesting a major bullish breakout. cryptocurrency analyst Dark Defender identifies a recurring 'phoenix flight' formation—a multi-year consolidation pattern previously seen in 2017 that preceded significant rallies.

The token has retested key resistance levels after breaking two cup-and-handle formations since 2013. Market observers now anticipate an 8-year cycle completion by 2025, mirroring the 4-year breakout that propelled XRP's historic 2017 surge. Institutional adoption remains a Core driver, with Ripple's expanding partnerships in global remittances adding fundamental weight to the technical case.

Analyst Warns of Final XRP Accumulation Phase Before Q4 Rally

Analyst Austin Hilton issued a stark warning for XRP investors, suggesting the current consolidation phase represents a final accumulation opportunity before a projected parabolic rally in Q4 2023. Despite September's typical market sluggishness, XRP has demonstrated unexpected strength by maintaining positions above key psychological levels.

Market dynamics point to growing institutional interest, with exchange reserves plummeting as whales MOVE tokens into cold storage. Coinbase alone has seen a 90% reduction in XRP holdings. This off-exchange movement, coupled with anticipated liquidity inflows from both retail and institutional players in Q4, could create a supply shock capable of driving significant price appreciation.

The analysis comes amid heightened activity across major exchanges including Binance and Coinbase, where demand for XRP has surged despite broader market uncertainty. Hilton's warning emphasizes the narrowing window for position-building before what he predicts will be a transformative market move for the embattled asset.

XRP Slides Below Key $3 Support as Remittix Gains Traction in Presale Market

Ripple's XRP has breached the critical $3 support level, sparking concerns among investors. Whale activity shows substantial sell-offs, with analysts divided on whether the token will test lower supports NEAR $2.70 or rebound toward $3.50. Technical indicators show conflicting signals, including a TD Sequential buy recommendation.

Meanwhile, Remittix has emerged as a standout in the presale market, achieving audited code, exchange listings, and wallet integration. Its payment-focused utility contrasts with XRP's current struggles, attracting attention as a potential alternative for DeFi and cross-border transactions.

Crypto Analyst Dismisses $10,000 XRP Price Target as Unrealistic

A prominent crypto analyst has pushed back against claims that XRP could reach $10,000, calling the prediction mathematically implausible. Adam Stokes, a market commentator, emphasized that global capital constraints make such a valuation impossible despite his personal holdings in the asset.

"There's just not enough money on planet Earth for that," Stokes remarked in a video shared by pro-XRP influencer Xaif. The analyst acknowledged XRP's growth potential but urged investors to ground expectations in market realities rather than speculative hype.

The intervention comes amid persistent debate within the XRP community about the token's price ceiling. While some holders anticipate exponential gains, Stokes' analysis reinforces the importance of fundamental valuation metrics in cryptocurrency markets.

How High Will XRP Price Go?

Based on current technical indicators and market sentiment, XRP shows potential for upward movement toward the $4.39 price target mentioned by analysts. The cryptocurrency currently trades at $3.0348, above its 20-day moving average, indicating healthy support levels. Key resistance sits at the Bollinger Band upper level of $3.1487, with a breakthrough potentially accelerating gains.

| Indicator | Current Value | Signal |

|---|---|---|

| Current Price | $3.0348 | Neutral/Bullish |

| 20-day MA | $2.9218 | Support Level |

| Bollinger Upper | $3.1487 | Key Resistance |

| MACD | -0.0930 | Weak Bearish |

While competition from new payment tokens presents challenges, institutional demand and supply constraints could drive prices higher in Q4, making the $4.39 target achievable with sustained bullish momentum.